Calyra Vellin Review 2026: The AI-Powered Trading Platform Built for Spaniards

In 2026, Spain’s crypto and trading scene is heating up, fueled by growing institutional adoption, clearer MiCA regulations, and a new wave of smart, localized tools. Among them, Calyra Vellin stands out as one of the boldest claims in the Spanish-speaking market: an AI-driven trading platform “made for Spaniards,” promising automated, high-precision crypto and multi-asset trading with a strong emphasis on local compliance, seamless banking integration, and Spanish-language support from start to finish.

Is Calyra Vellin genuinely a game-changer for everyday investors in Madrid, Barcelona, Valencia, or Málaga, or is it another overhyped bot in a crowded space? Let’s dive deep.

What Exactly Is Calyra Vellin?

Calyra Vellin is not a classic centralized exchange or a traditional broker. Instead, it acts as an intelligent AI overlay that connects to top-tier regulated global exchanges and licensed brokers, giving Spanish users access to crypto, forex, indices, and select commodities through powerful algorithmic strategies. The core selling point is full automation powered by advanced machine learning: bots that scan markets 24/7, detect patterns, generate high-probability signals, and execute trades without requiring constant user supervision.

What makes it feel “Spanish-first” is the attention to detail: flawless Spanish interface, 24/7 live support in Castilian Spanish, instant SEPA deposits and withdrawals from major Spanish banks (Santander, BBVA, CaixaBank, etc.), fast DNI/NIE verification, and repeated emphasis on full compliance with CNMV and EU MiCA rules. The platform claims its AI models were fine-tuned on years of volatile market data, offering ready-to-deploy strategies ranging from ultra-short scalping to medium-term trend-following on Bitcoin, Ethereum, Solana, and emerging altcoins.

Assets & AI Capabilities

Users gain exposure to 200+ cryptocurrencies (BTC, ETH, SOL, XRP, ADA, top memecoins, stablecoins), plus forex pairs, European indices, gold, and oil via partner liquidity providers. The real star is the AI engine:

- Live trading signals with push notifications and Telegram integration

- Unlimited demo mode to test bots risk-free

- Auto-optimized portfolio allocation based on risk profile (conservative / balanced / aggressive)

- Predictive analytics combining on-chain data, social sentiment, news flow, and technical indicators

- Backtested win rates advertised above 80% (standard disclaimer: past performance ≠ future results)

Trading Experience: Maximum Automation, Retain Human Control

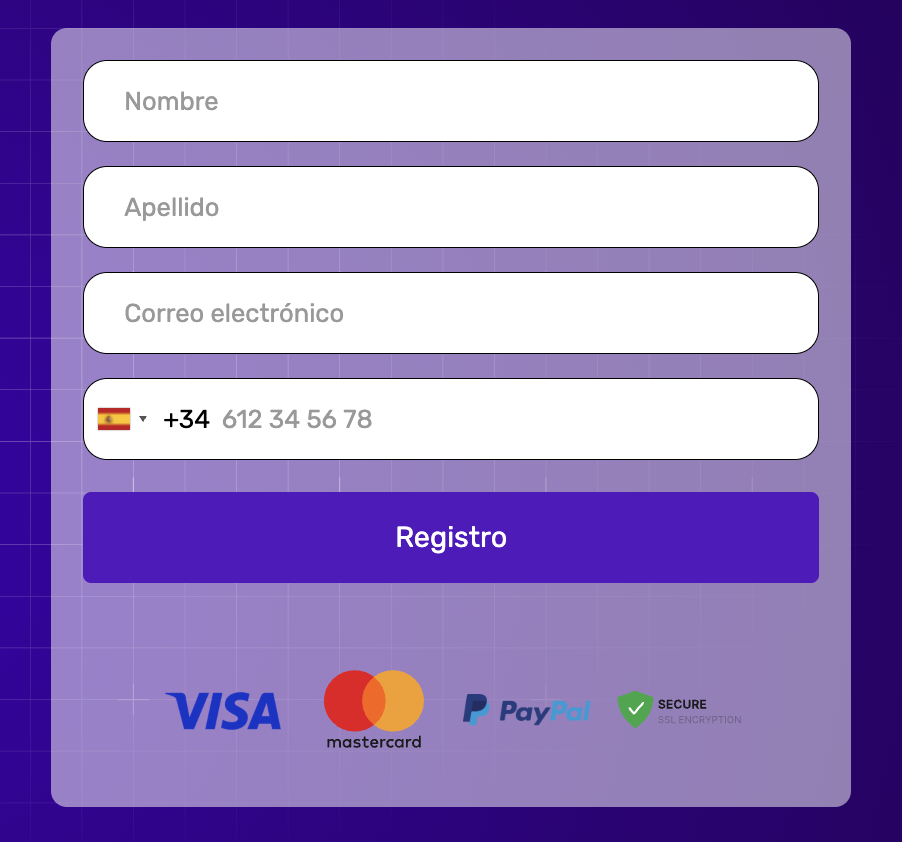

Setup is straightforward: minimum deposit of €250, choose or customize a strategy, fund the account, and let the bots run. Yet it’s not fully “set and forget” – users can intervene anytime with manual overrides, dynamic stop-loss/take-profit, trailing stops, and position sizing rules. The dashboard is clean, mobile-optimized, and surprisingly beginner-friendly for a high-tech platform, making it appealing to busy professionals who want crypto exposure without living on TradingView.

Fees & Cost Transparency

Calyra Vellin keeps it refreshingly straightforward:

- No hidden fees or monthly subscriptions

- Competitive spreads starting from 0.1% on major pairs

- Performance fee (15–20%) only on profitable trades generated by the bots

- Zero inactivity fees

- Premium tier (deposits > €5,000) unlocks lower fees, priority support, and exclusive high-frequency bots

Security & Regulatory Alignment

Security highlights include:

- Bank-grade AES-256 encryption

- Mandatory 2FA and strict KYC

- No direct custody of funds (assets held by regulated partner exchanges/brokers)

- Full MiCA and CNMV compliance focus

- No reported breaches to date (platform still relatively young)

Spanish users especially appreciate the emphasis on local data protection laws and clear risk warnings.

Passive Income Options

Beyond active automated trading, Calyra Vellin links to staking pools, yield-bearing stablecoin products, and select DeFi opportunities through trusted partners. The AI can recommend the best passive setups based on current market volatility – a nice bonus for users who prefer to “set it and enjoy the beach” rather than trade every day.

Who Is Calyra Vellin Best For?

Ideal for:

- Spanish residents aged 25–55 looking to automate crypto exposure

- Professionals with limited time who want smart assistance

- Intermediate investors ready to start with €500–€2,000 and scale up

- People who value Spanish-language support and local banking convenience

Less suitable for:

- Pure manual day-traders who hate bots

- Complete beginners with only €50–100 to invest

- Users who demand a 10-year track record from day one

Pros & Cons – The Balanced View

Major Strengths

- Highly localized for Spain: language, banks, regulation

- Powerful, ready-to-use AI trading strategies

- Low entry barrier (€250 min) + free unlimited demo

- Transparent performance-based fee model

- Responsive 24/7 Spanish support + growing community

Key Drawbacks

- Relies on third-party liquidity providers (execution speed & depth can vary)

- AI performance fluctuates with market conditions (no holy grail)

- Relatively new platform – long-term reliability still proving itself

- Requires basic understanding to configure bots optimally

- Not designed for ultra-low-budget or ultra-manual traders

Final Verdict – 2026 Perspective

Calyra Vellin enters 2026 as one of the most polished and genuinely “Spanish-first” AI trading solutions available. It doesn’t try to replace Binance or Bybit – it enhances access to global markets with intelligent automation tailored to the needs, language, and banking habits of Spanish users.

In a space full of exaggerated promises, Calyra Vellin stands out through strong localization, regulatory awareness, and a user-centric approach. Is it worth your time and money? For Spaniards who want to participate in crypto’s growth intelligently and with minimal hassle – yes, it’s a serious contender. Start with the demo, test conservatively, never invest more than you can afford to lose, and always do your own due diligence. In 2026, for many Spanish investors seeking an edge without complexity, Calyra Vellin could very well be the smart choice they’ve been waiting for.