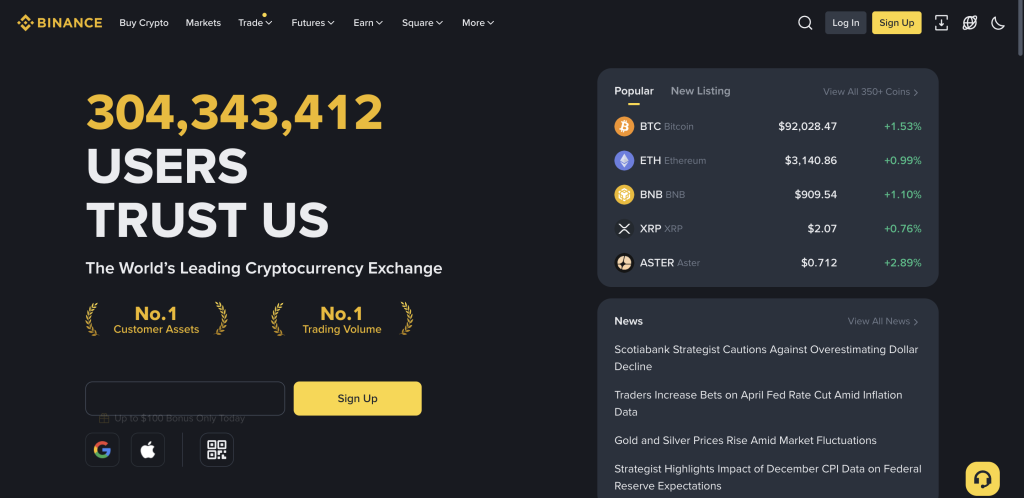

Binance Review: An In-Depth Analysis of the World’s Most Influential Crypto Exchange

When people talk about Binance, they often reduce it to a single phrase: “the biggest crypto exchange in the world.”

That statement is technically true — but it is also deeply incomplete.

Size alone does not explain why Binance has managed to stay at the center of the crypto market through bull cycles, brutal crashes, regulatory pressure, and constant competition from newer platforms. To understand Binance properly, you have to look at how it actually works in practice: how it feels to trade on it, where it excels, where it creates friction, and which type of user benefits most from its ecosystem.

This review is the result of detailed research, direct platform usage, and comparison with other major exchanges used by both retail and advanced traders.

Binance as a Platform, Not Just an Exchange

Binance stopped being “just an exchange” years ago.

Today, it operates more like a crypto financial infrastructure layer, combining centralized trading, on-chain tools, passive income products, and Web3 access under one ecosystem.

This matters because most users don’t interact with crypto in a single way. A trader might speculate on BTC today, stake ETH tomorrow, explore new tokens via Launchpad next month, and move assets on-chain without wanting to juggle five different platforms.

Binance is built precisely around this multi-use reality.

Asset Availability and Market Depth Explained Properly

How Many Coins Are Actually Useful?

Binance supports hundreds of cryptocurrencies, but the real strength is not the raw number — it’s liquidity distribution.

Many exchanges list a large number of coins, yet only a fraction of them have meaningful volume. On Binance, even mid-cap and smaller-cap assets tend to have enough liquidity to allow:

- Market orders without brutal slippage

- Reliable limit order fills

- Efficient scaling of position size

This is especially important during volatile market conditions, where thin order books on smaller exchanges can destroy execution quality.

Trading Pairs and Base Assets

Binance offers trading pairs across:

This flexibility allows traders to structure positions efficiently without unnecessary conversions, which indirectly reduces costs.

Spot Trading: How It Feels in Real Use

Binance’s spot trading environment is often underestimated because people focus only on fees.

In practice, three things stand out:

- Execution speed – Orders are processed quickly even during extreme volatility

- Order variety – Advanced orders are available without complexity

- Charting integration – Full TradingView functionality is built directly into the platform

For active traders, this combination reduces the need for external tools and manual workarounds.

Beginners can start with simplified layouts, while experienced traders can fine-tune strategies without feeling limited.

Futures, Margin and Leverage: Power With Responsibility

Binance is one of the dominant players in derivatives trading — and this is where many exchanges fail users by oversimplifying risk.

Futures Trading Breakdown

- USDT-margined futures for simplicity

- Coin-margined futures for advanced hedging

- Adjustable leverage per position

- Isolated and cross margin options

Risk controls such as funding rate transparency, liquidation price visibility, and margin ratio indicators are clearly displayed — something that genuinely reduces avoidable mistakes.

However, this is not beginner territory, and Binance does not pretend otherwise.

Fees: Not Just “Low”, But Structurally Efficient

Most reviews say “Binance has low fees” and stop there. That’s lazy.

What Actually Matters About Binance Fees

- Base spot fee of 0.10% is already competitive

- Using BNB reduces fees automatically without extra steps

- High-volume traders scale into lower tiers logically

- Futures maker fees are extremely attractive for liquidity providers

More importantly, Binance avoids hidden costs:

- No inflated spreads

- No forced “convenience” markups

- Transparent withdrawal fees based on network conditions

For anyone trading regularly, these details compound into serious long-term savings.

Security: Practical Protection, Not Marketing Buzzwords

Security is not about claiming to be “safe”. It’s about layers.

Binance applies multiple defensive mechanisms:

- Mandatory two-factor authentication

- Device and IP verification

- Withdrawal address whitelisting

- Real-time monitoring for abnormal behavior

The SAFU fund acts as a final safety net — not a replacement for security, but an added layer of accountability.

Is Binance risk-free? No centralized exchange is.

Is it careless? Absolutely not.

Binance Earn: Making Idle Assets Work

One of Binance’s most underrated strengths is how it structures passive income.

Earn Products Explained Simply

- Flexible products for liquidity access

- Locked products for higher yield

- Launchpool for early exposure to new projects

- ETH staking with liquidity options

Each product clearly states:

- Lock-up period

- Estimated yield

- Redemption conditions

This transparency is crucial, especially in a market where yield products are often misunderstood.

Web3, Wallets and On-Chain Integration

Binance understands that users are slowly moving on-chain — but don’t want friction.

The Binance Web3 Wallet allows:

- Self-custody

- DEX access

- NFT interaction

- Cross-chain bridging

What makes it effective is integration, not novelty. Assets move smoothly between centralized and decentralized environments without forcing users to relearn everything.

Regulatory Reality and Geographic Limitations

Binance operates globally, but not uniformly.

Features, leverage limits, and fiat access depend on jurisdiction. This is not unique to Binance, but its scale makes compliance more visible.

The important point:

Restrictions are communicated clearly, and accounts are segmented properly rather than relying on vague enforcement.

Pros and Cons After Real Evaluation

Strengths

- Deepest liquidity in the market

- One of the lowest fee structures available

- Broad ecosystem covering nearly all crypto use cases

- Advanced tools without sacrificing usability

- Strong security culture

Weaknesses

- Learning curve for complete beginners

- Product availability varies by region

- Support load spikes during extreme market events

Binance in Context: Who It Is Actually For

Binance is not only for professionals — but it shines brightest for:

- Active traders

- Long-term investors

- Users who want everything in one ecosystem

- Those who value efficiency over hand-holding

If someone trades once a year, Binance may feel excessive.

If crypto is a regular part of financial activity, Binance becomes hard to replace.

“Binance doesn’t try to be simple. It tries to be complete — and that’s a critical difference.”

Final Perspective

After detailed analysis, testing, and comparison, Binance remains the benchmark platform in the crypto industry.

Not because it is perfect — but because it consistently delivers liquidity, tools, and infrastructure at a level competitors still chase.

For users who take crypto seriously, Binance is not just an option.

It is often the reference point.

Pingback: Bursa AI | Platformă de tranzacționare criptomonede cu AI: recenzii, legalitate și rezultate